Introduction

You exchange information with your tax advisor through TULIP when preparing your tax return. You will receive a tax Questionnaire in your account that is used to share necessary data and information and to upload documents. This guide describes the most common questions and also the entire process.

Frequently asked questions

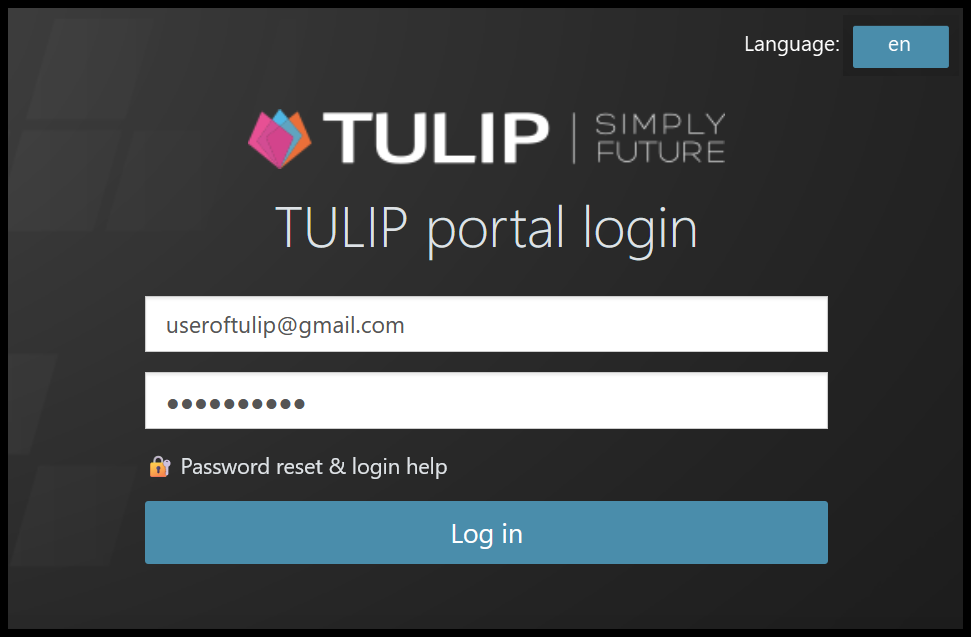

I can’t log in to TULIP.

If you forgot your password/your password is expired, click the reset password button on the login screen and create a new one.

If there is some other issue, contact us.

I have some questions related to tax or the tax calculation.

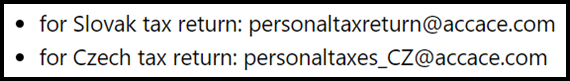

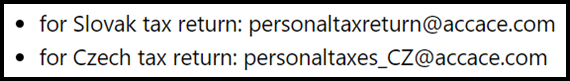

Please contact the person who is processing your tax return:

What does a Username mean? Where can I find it?

A Username is a set of numbers and letters. It cannot be repeated in any other TULIP account.

It is used to separate two accounts with the same email address (e.g. employee account for attendance, payroll, business trips & personal account for a Tax Questionnaire).

Find your Username in the welcome email (the first email notification after your TULIP account is created).

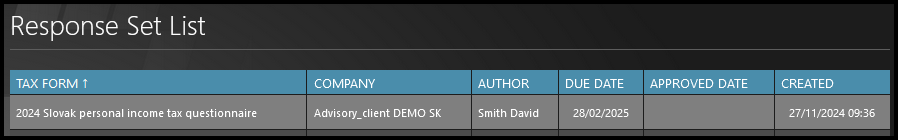

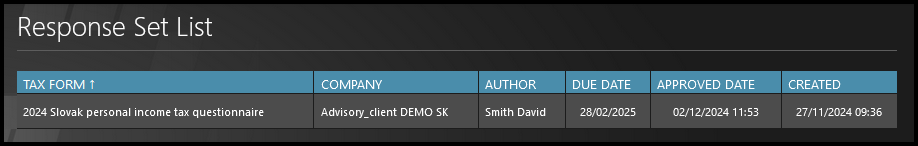

Where are my tax return documents from previous year/s?

Go to Tax forms tile and click on the desired form – you can see all your forms in one place now. Click here to see more.

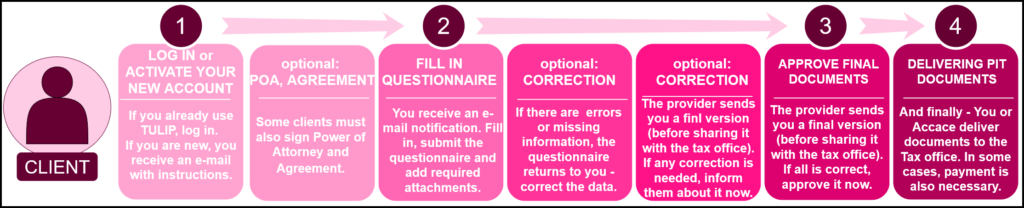

Steps

You will receive email notifications (from notifications@tulipize.com) of the next step during the preparation of your tax return. Here is the complete procedure:

- You will receive an activation email.

- Once activated/logged in, you can see the Questionnaire (or documents to sign: Service Agreement and Power of Attorney). Complete and submit the Questionnaire and documents by the deadline.

- After completing and submitting the Questionnaire (and, if applicable, the documents to be signed), the tax advisor will prepare your tax return and upload it into TULIP. This is where your review and approval is required.

- In the same place you will also find a cover letter summarizing the next steps (the specific steps for filing and payment are tailored to each client individually – these may be instructions for submitting the tax return or payment instructions). Therefore, once you approved the tax returm, follow the information in the cover letter.

1. Log in / Activate your new account

A) You already have a TULIP profile

If you use TULIP for other reasons (access to your own payslips, attendance, accounting or HR functionalities etc.), there are two options where PIT will be shared with you, and you will always receive instructions on how to proceed in your email:

a) PIT Questionnaire is available to you in your current account (most of the Czech clients)

b) PIT Questionnaire in sent to you via second account created only for PIT purposes. Activate your new account. Log into your accounts using a Username instead of your e-mail (most of the Slovak clients)

B) Activate new TULIP account

You receive an e-mail notification (from notifications@tulipize.com) – please activate your account now.

2. Fill in the Questionnaire

– E-mail notification –

You receive an e-mail notification with instructions (regarding POA, Agreement and other information) – click the link in e-mail.

– Tile –

Or, you can log in to TULIP directly and go to My Tasks tile. Find the Questionnaire here every time when it requires your activity.

In the Tax return tile, you’ll find all your Questionnaires and related documents, including those you’ve completed in the past.

Click on the Questionnaire you want to open.

– Personal data & Agreement & POA –

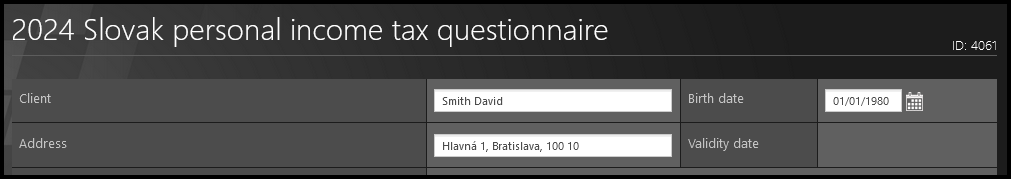

Personal information

Check and edit your personal information. Be careful – fill in blank fields and correct any typos!

It serves as the basis for the final PIT Document, ´Agreement on Provision of Services´ and ´Power of Attorney´ documents.

Clients who already requested the service in previous years can already have some information pre-filled.

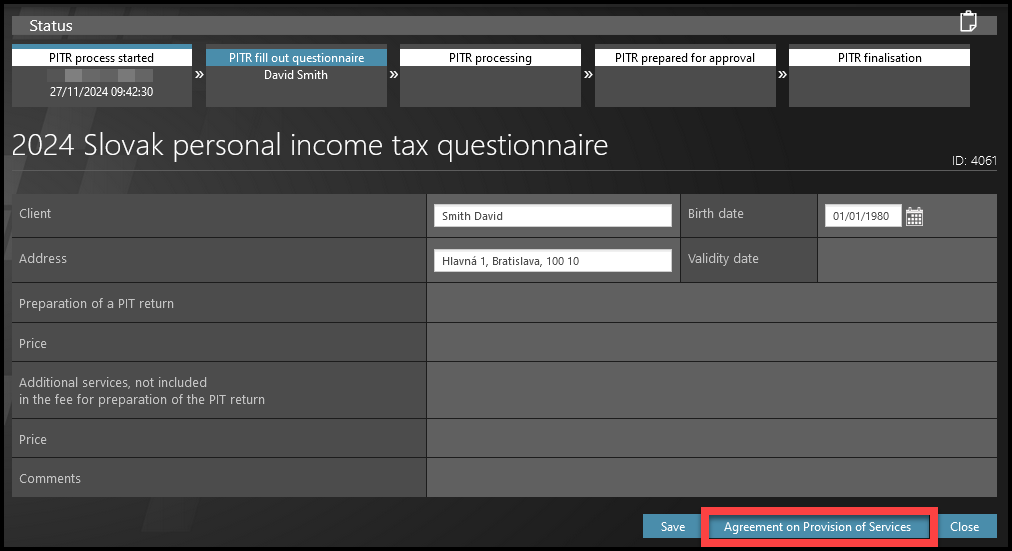

Agreement (where relevant)

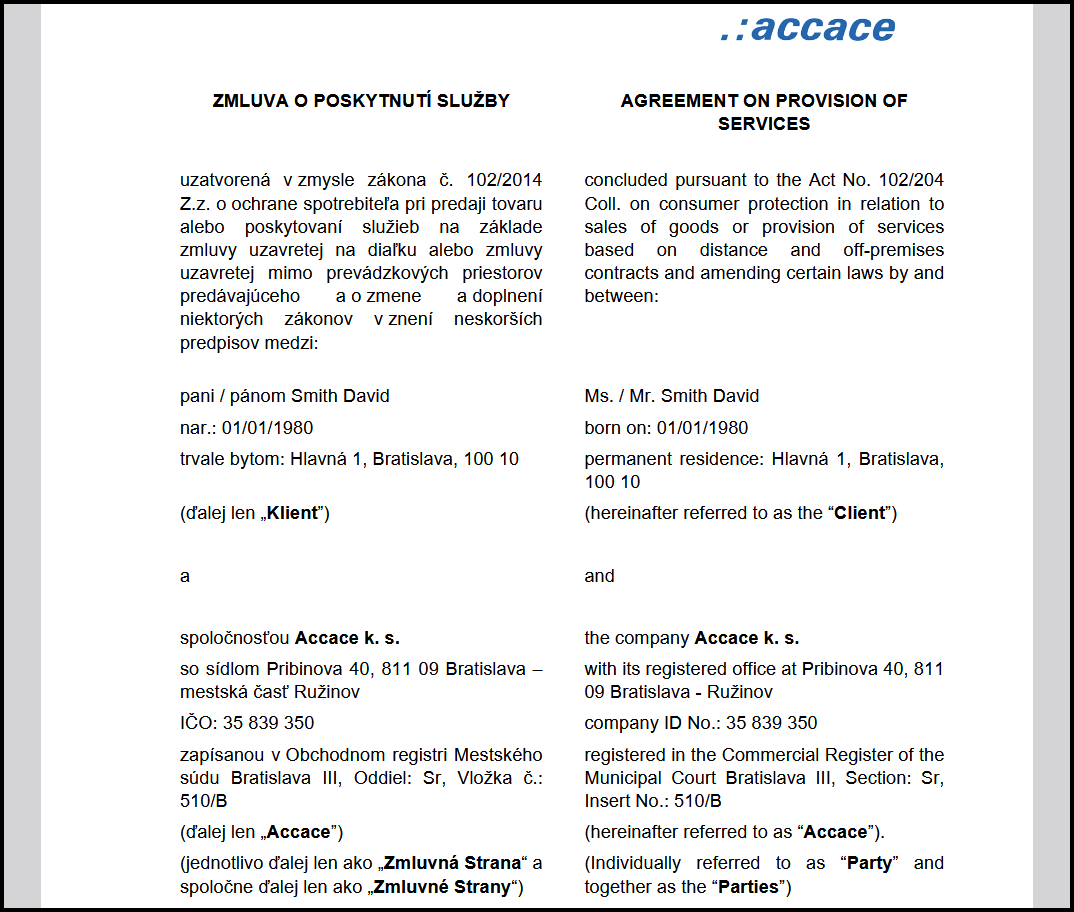

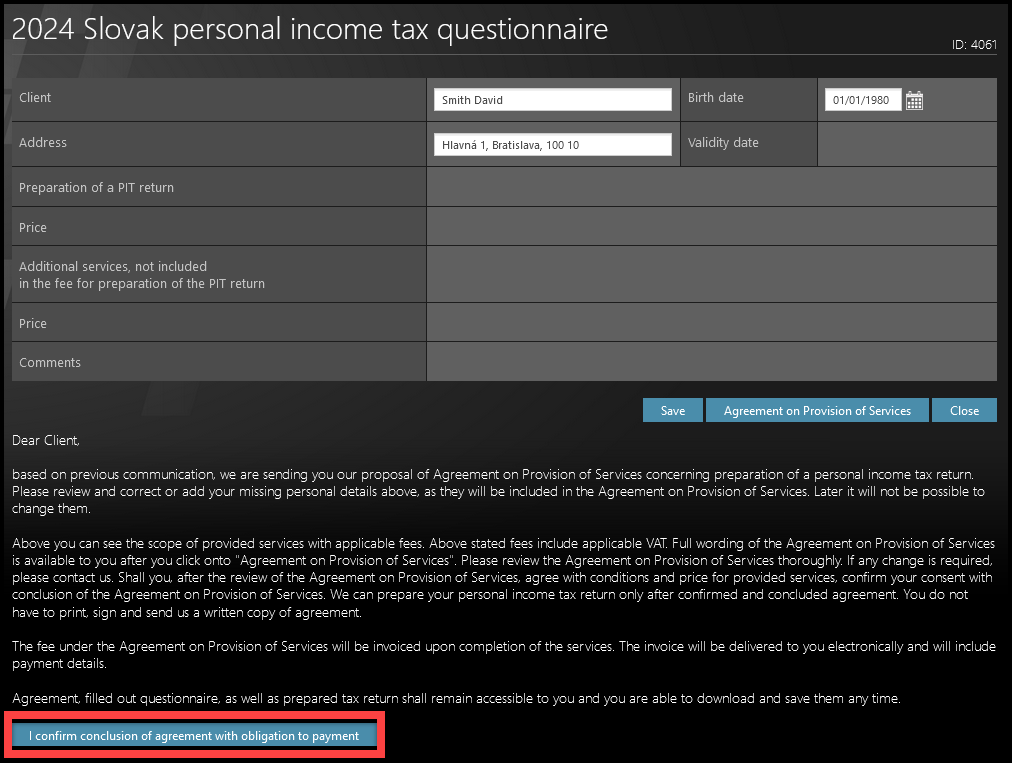

Click on the ´Agreement on Provision of Services´ button to download a file.

Open the document and read it carefully.

Click the button on the bottom of the page ´I confirm conclusion of agreement with obligation to payment´.

After that, a tax Questionnaire is available to you.

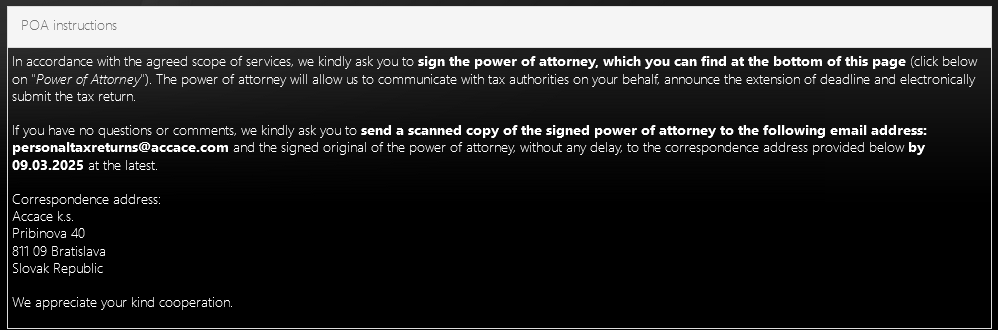

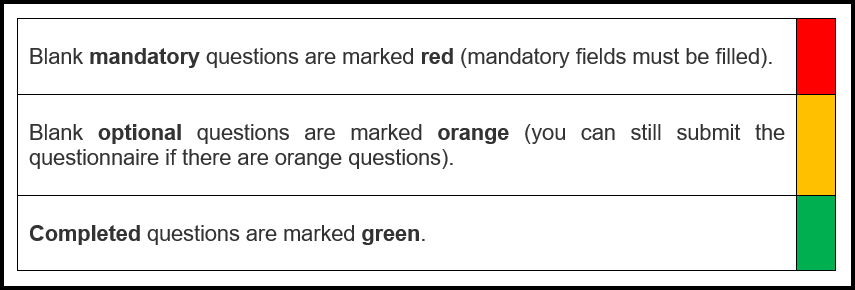

Power of Attorney (where relevant)

If you are delivering the PIT documents to the tax office by yourself, you will not see this step.

If the PIT documents will be delivered by the provider, please sign the POA document:

- Click on the button “Power of Attorney” at the bottom of the page.

- Read the conditions.

- Print the document.

- Sign the printed document.

- After the signing, scan the document and send it to the e-mail address in the instructions.

- Send the original of the signed document to physical address in the instructions.

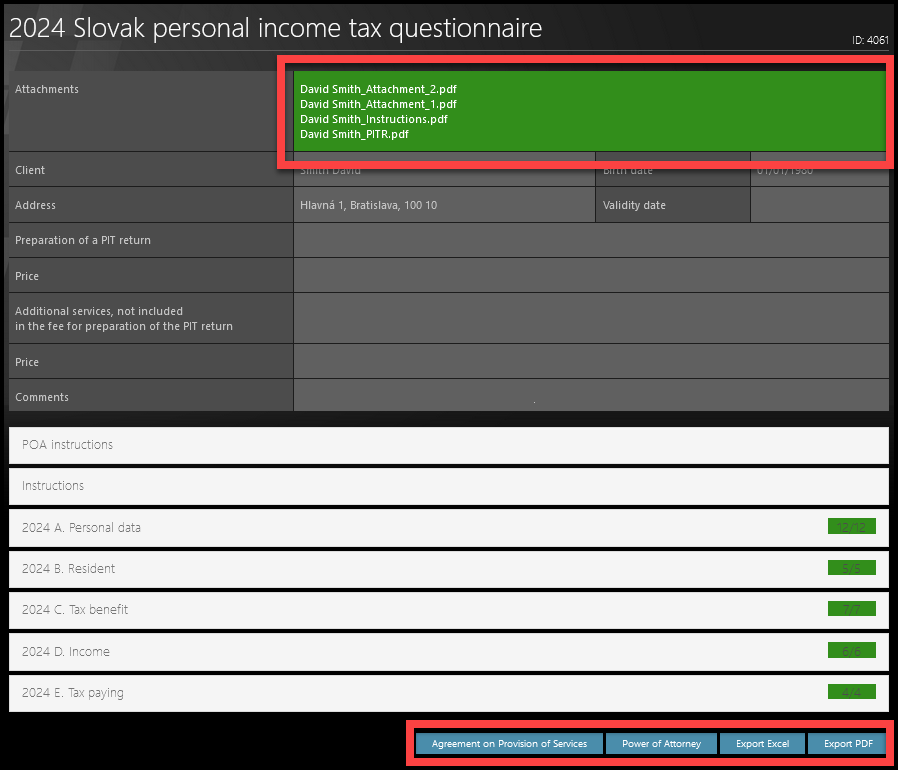

You will have an unlimited access to the documents related to your tax return (Contract, Power of Attorney, completed tax returns, attachments) in your TULIP profile – in the “Tax return” tile – and you can view or download them at any time.

– Tax Questionnaire –

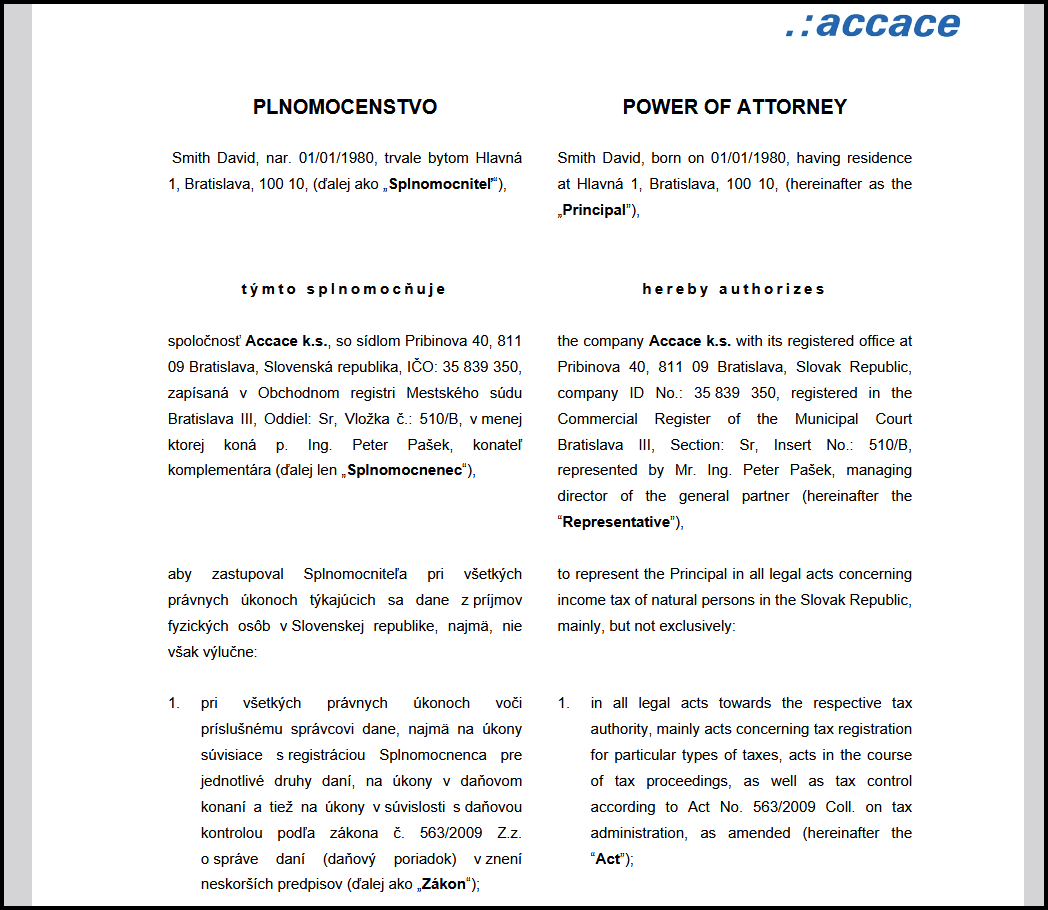

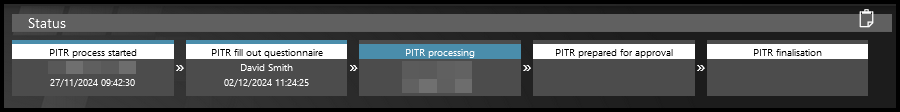

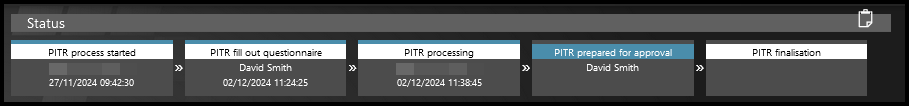

Status bar

On the top of the page, you will always see the Status bar. It displays the actual step of the process. You can communicate with the provider via e-mail anytime during the process.

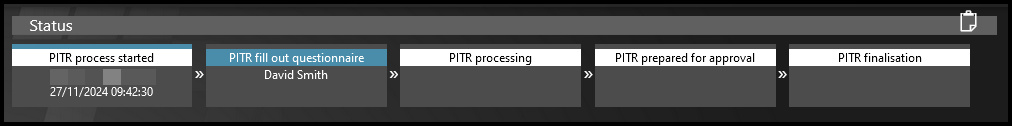

Explanation of colors

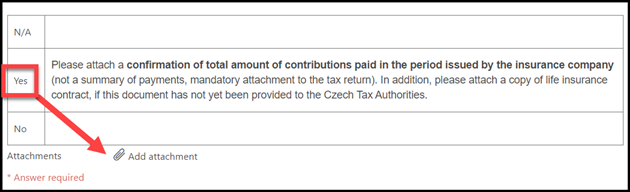

- Answer all the red questions. If any of those answers is missing, TULIP will notify you.

- Some questions interactively roll-out a new section of questions based on your answers.

Attachments

If there is an Add attachment button, you must usually click on it. It is possible to attach multiple documents at once.

Please note that some documents may be a mandatory part of the tax return and therefore it is necessary to attach them.

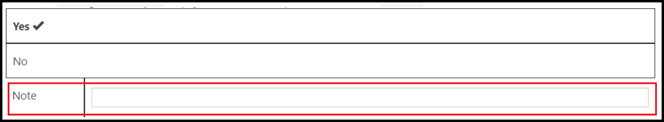

Notes

Add a Note if you need to add any additional information.

Questions

Please contact the person who is processing your PIT documents:

– Send the Questionnaire –

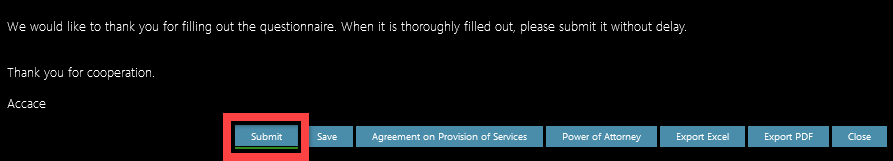

Scroll down to the bottom of a page.

- Click SUBMIT – this button saves & sends it for further processing. Once you click Submit, you will not be able to edit the Questionnaire. If you need to change something later, please send an e-mail to the person who is processing your tax return (see the screenshot in the previous step).

- Click SAVE – and to continue filling in the Questionnaire later. To return to the saved version, go to Tax return tile.

- Agreement on Provision of Services – Here you can download the Agreement.

- Power of Attorney – Here you can download the Power of Attorney (you will see this button only if it is relevant).

- EXPORT buttons – Download the current version of the Questionnaire (in xls or pdf format). Those buttons do not download final documents that should be delivered to the tax office, only the answers in your Questionnaire.

– Processing your answers –

You are not able to edit the Questionnaire now, as the current status is PITR processing – the contact person is processing your data.

You will receive an e-mail notification if any action is required from you.

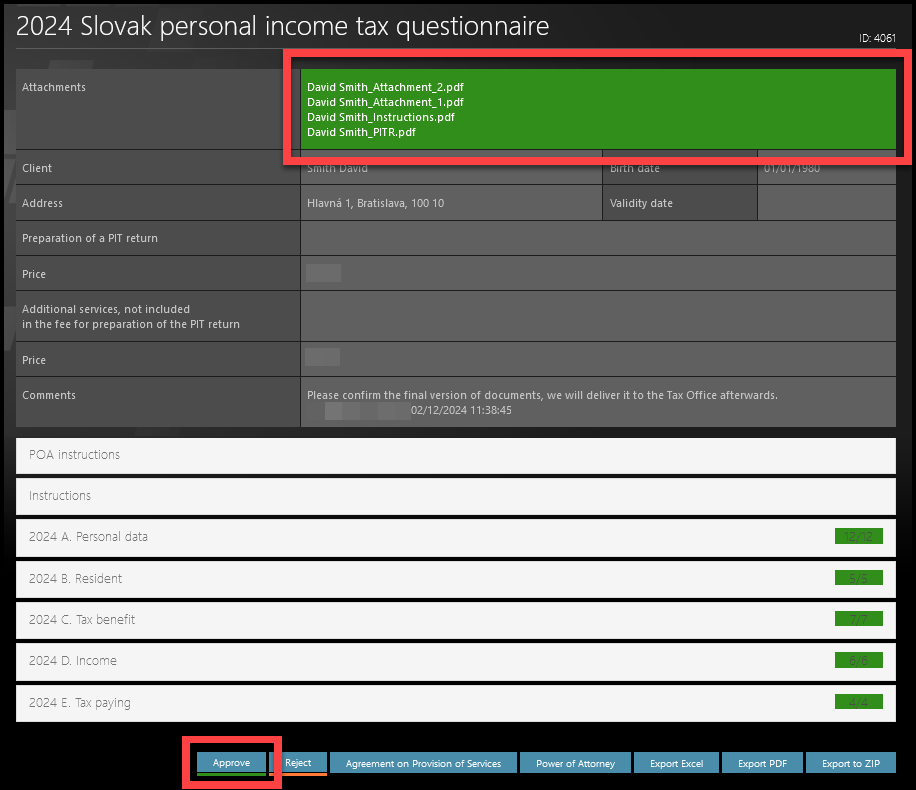

3. Approve tax return documents

– Confirm the final version –

You will receive an e-mail notification asking you for your approval of the documents after the responsible person processes your answers, Your confirmation is necessary especially in case they are delivering the documents to the Tax office.

Open the documents in the green box at the top of the page – Here you can download the final version of your tax return and other related documents (or filing instructions and payment instructions). You can access these at any time under the “Tax Return” tile.

If you are filing your own return, you will have a ready-to-file version with the appropriate attachments (in .pdf format for printing or .xml format for electronic filing).

Approval/Rejection:

- Approve – Click on this button to confirm the final documents (click here only if you do not have any comments or requests for changes).

- Reject – if any necessary changes need to be made, you can reject the prepared return and it will be sent back to the tax advisor. You must add a comment explaining why you are rejecting it and what needs to be corrected.

- Agreement on Provision of Services – Here you can download the Agreement.

- Power of Attorney – Here you can download the Power of Attorney (you will only see this button if it is relevant for you).

- EXPORT buttons – Download the current version of the Questionnaire (in xls or pdf format). Those buttons do not download documents in green area on top of the page.

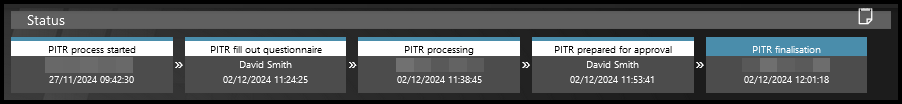

4. After the approval

– Delivering & payment –

Your tax return is ready to be filed:

- Submitted by Accace: If you have given us Power of Attorney, we will take care of filing the return and attachments. Once filed, we will upload the filing confirmation to the portal and you will receive a confirmation email.

- You file the documents yourself in paper form: Print out the tax return from the .pdf attachment, attach the originals of the required attachments listed in the cover letter , sign it (if applicable, also sign the overpayment claim) and deliver it to the tax office. Detailed instructions can be found in the covering letter.

- You file the documents yourself electronically (mandatory for data box holders): Download the .xml format and deliver it to the tax office. Detailed instructions can be found in the covering letter.

Check the resulting amount on your tax return:

- If the result is overpayment of tax,, this amount will be credited to your account by the tax office no later than 30 days after the deadline for filing your tax return. For example: if the filing deadline is 1 April, you will receive the overpayment of tax no later than the end of April or the beginning of May.

- If the result is an underpayment of tax, pay this amount to the tax office’s account – follow the information and payment instructions in the letter accompanying your tax return.

– Finalization of PITR –

The person responsible for processing your PIT return ends the workflow in TULIP as the last step.

– My Tax return –

Find all your PIT documents: Go to Tax return tile.

Click on a form, the detail of it will be displayed.

Attachments in green area (on the top of the page) – here you can find these documents:

- final PIT tax return that should be delivered to the tax office and attachments, a necessary part of the tax return

- instructions, FAQ

You must deliver the documents to the tax office by yourself only if you did not sign the Power of Attorney.

Buttons (on the bottom of the page):

- Agreement on Provision of Services – you can download the file

- Power of Attorney (if relevant) – you can download the file

- Export XLS or Export PDF – download the last version of the Questionnaire with attachments