Introduction

Annual Tax Reconciliation (RZD) is a summary of your income tax from dependent activity, for example employment. It can be overpayment or underpayment. Via TULIP, you exchange information with the person who processes your Annual Tax Reconciliation. This guide describes the most common questions and also the entire process.

Please note a TULIP setup you see always depends on custom requirements and access settings of TULIP for your company. Not all companies use the functionality to process and distribute Annual Tax Reconciliation to employees.

Frequently asked questions

When filling in my birth number or name, an error pops up.

- Check if the name looks correct – delete any extra spaces before, within or after your name.

- Ensure all fields with your name or birth number are in a consistent format.

- Enter your name and birth number manually to avoid copying unwanted spaces or characters that can cause errors.

- Make sure your birth number includes a slash (/) and the format is ” 1 2 3 4 5 6 / 7 8 9 0 “.

If you have a foreign birth number, it might be subject to a validity check that doesn’t accept all formats. In this case, contact your employer or the person handling your tax form to discuss what to do next.

I have questions about taxes or tax calculations.

Please contact the person who processes your Annual Tax Return. If your Annual Tax Return is processed by your employer, ask your HR department for assistance.

Contact TULIP support in case of technical problems with your account – e.g. if you cannot log in to your account, if you are receiving an error, if you cannot submit the form, etc.

I can’t log in to TULIP.

If you have forgotten your password or it has expired, click the reset password button on the login screen and create a new password.

Did your employment end and now you can’t log in?

- It’s possible that resetting your password won’t work because your account is terminated.

- The standard time frame where logging in is allowed (and also resetting your account password) is one month after your employment ends. Some companies may have a different time frame, such as three months.

- Contact the HR department at your previous employer. They will let us know and confirm reactivation of your account.

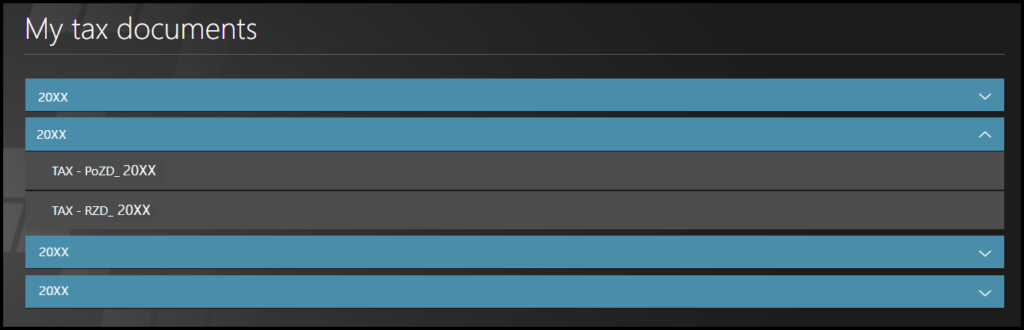

Where can I find the results of the Annual Tax Reconciliation from previous years?

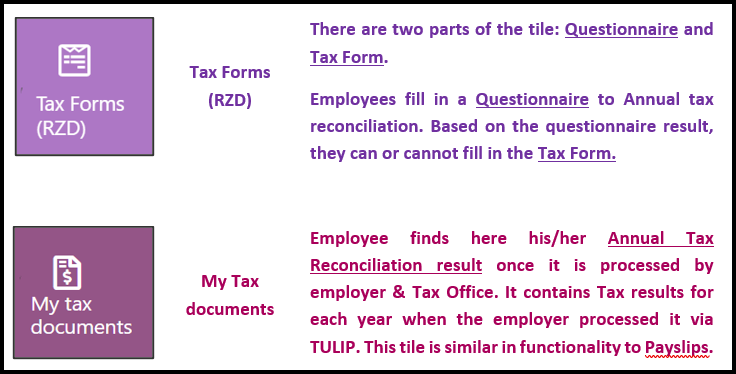

Go to My Tax Documents tile, where you can find the entire history of documents that have been sent to you.

Steps

How your request is processed in TULIP

- Create a new request – fill in a Questionnaire and then the Tax Form.

- Sign electronically directly in the form to confirm your data.

- Payroll will process the data and upload the result in TULIP for you.

TULIP tiles used for Annual Tax Reconciliation purposes

Questionnaire

Step 1 – Tile

Go to Tax forms (RZD) tile.

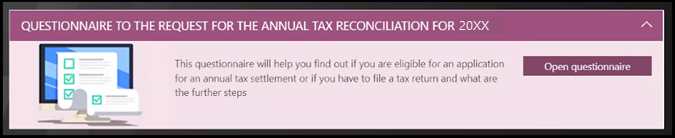

Step 2 – Questionnaire

Click on the Open questionnaire button.

This Questionnaire must be filled in first, before you fill in the Tax form.

It helps you to decide if you can request the annual settlement by the employer or if you must do it by yourself.

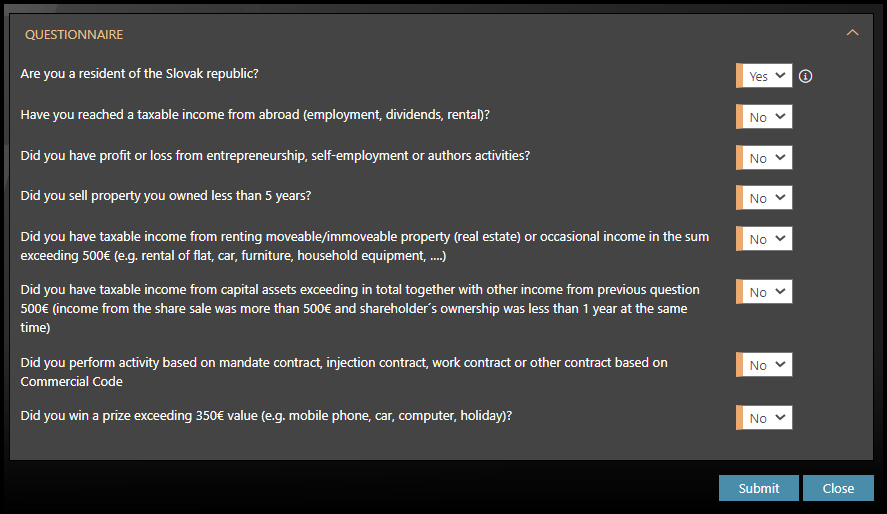

Step 3 – Questions

Answer the questions. You must fill in the fields with an orange stripe.

Click Submit.

Step 4 – Pop-up information

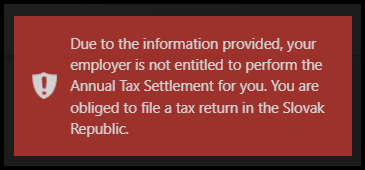

You will get a pop-up information whether you can or cannot continue to fill in the Tax Form.

Option A)

- If you cannot fill in the Tax Form in TULIP, it means your employer cannot process the Annual Tax Reconciliation for you.

- Fill in the form on your own or ask a professional for help:

- Request the Confirmation of income for previous calendar year from all your employers for previous year.

- Get a Tax return form – a paper version, an electronic version online or you can contact a provider who will help you with that process.

- Deliver the documents (physically/electronically) to the Tax Office until 31st March.

- Tax Office will process your data – please note it can be overpayment or underpayment.

- You will receive the result via post and a payment to your bank account.

- Do not continue in this manual.

Option B)

- If you are allowed to fill in the Tax Form in TULIP, it means your employer can process the Annual Tax Reconciliation for you.

- Follow this manual and continue.

Tax Form

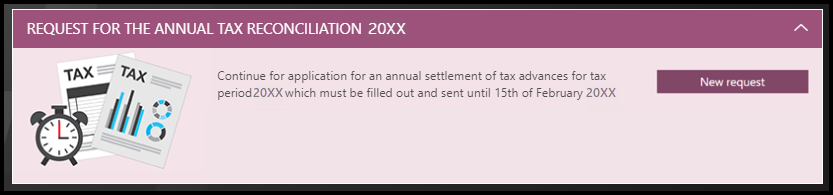

Step 1 – New request

Click on the New Request button.

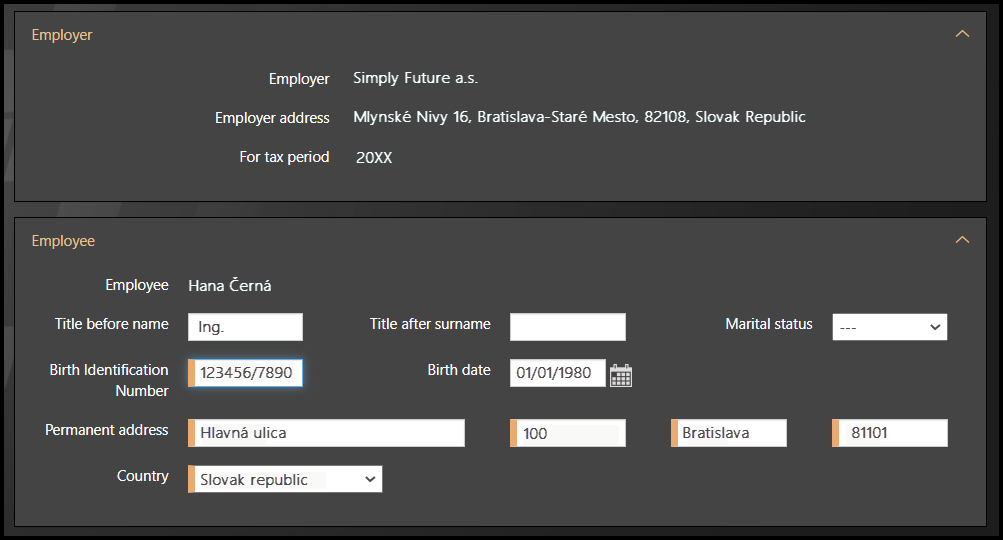

Step 2 – Personal information

First, fill in or correct your personal information at the beginning.

You must fill in the fields with an orange stripe.

Step 3 – Introduction to the form

There is maximum of 4 categories in Tax Form. The number depends on your answers.

- Employee

- Non-taxable amount of the tax base

- Tax allowances

- Previous employers

Anytime while filling in the form, you can:

- Click Save button. This will save the information in your form, and you can return to it later. Find it in the Tax Forms (RZD) tile or My Tasks tile.

- Click Close to leave the form. Your changes will not save and will be deleted.

Fill in all fields with an orange stripe, otherwise you cannot submit the form.

Please note that not just questions but also some attachments may be a mandatory part of the tax form, and it is not possible to submit your documents to Tax Office without them.

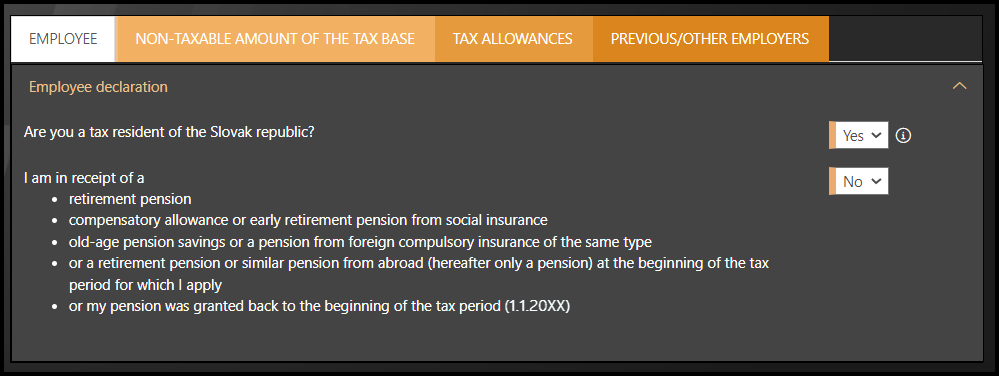

Step 4 – The Form

Employee

You must fill in the fields with an orange stripe.

Depending on your answers, some other categories, like Tax Allowances will appear.

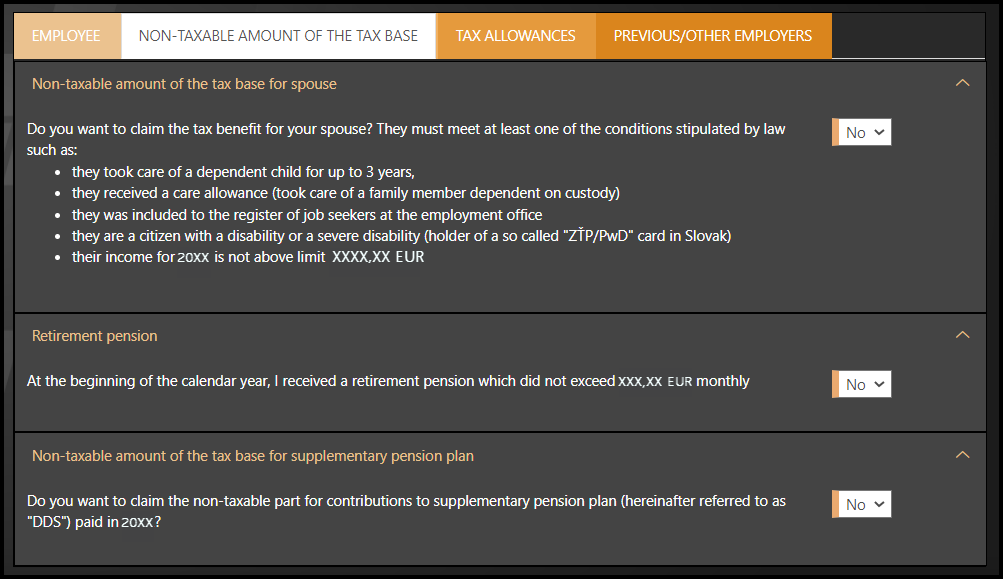

Non-taxable amount of the tax base

You must fill in the fields with an orange stripe.

Depending on your answers, some additional categories or questions may appear.

Tax allowances

You must fill in the fields with an orange stripe.

Depending on your answers, some additional categories or questions may appear.

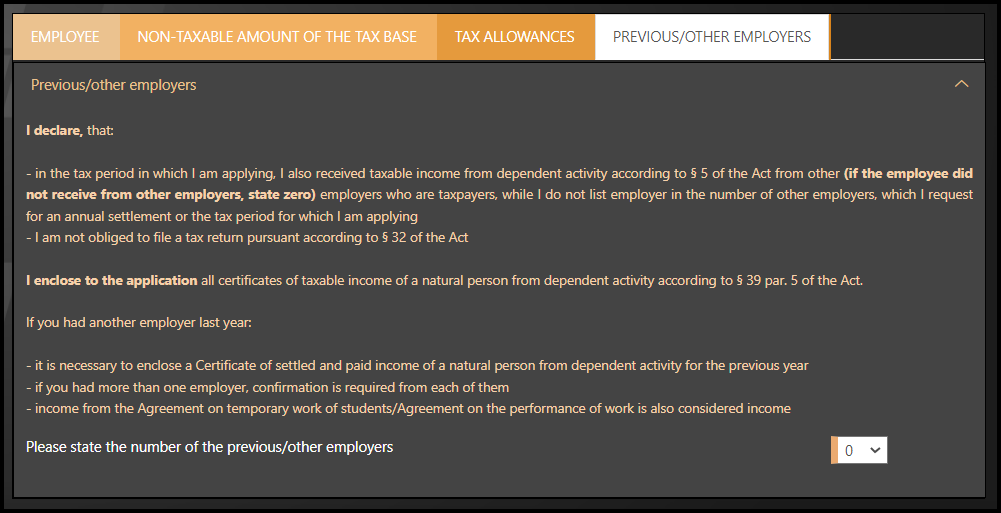

Previous/other employers

You must fill in the fields with an orange stripe.

Depending on your answers, some additional categories or questions may appear.

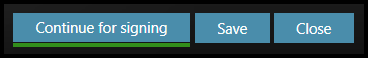

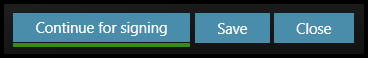

Step 5 – Continue for signing

After you fill in the whole form, click on Continue for signing button.

- There are various checks in the form to ensure that the form is completed in its entirety, as correctly as possible and without errors.

- Once you click on the Continue for signing button you cannot edit the form.

- The deadline for signing and submitting the form in TULIP is 15th February.

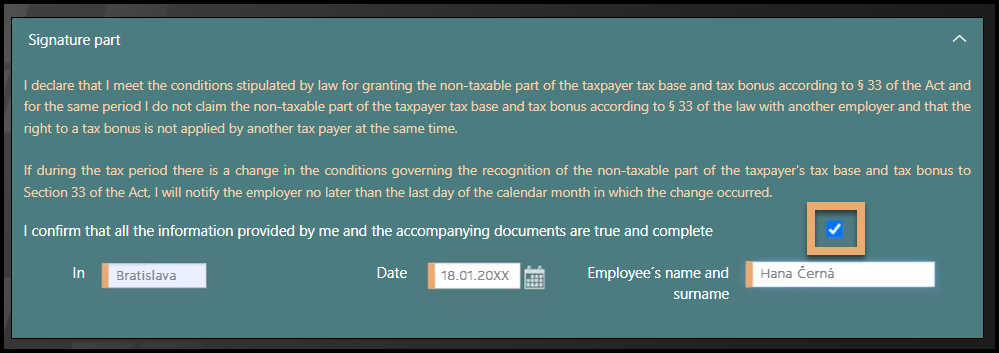

Step 6 – Declaration

Read the text.

Tick the checkbox.

Fill in some data:

- Place

- Date

- Your Name & Surname

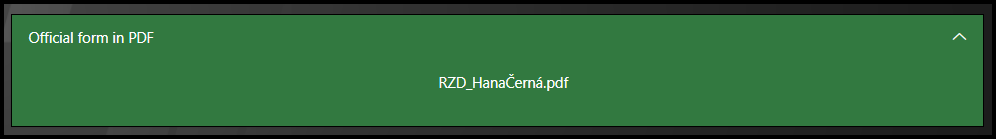

Step 7 – Download file

You can download documents with the data you filled into TULIP in PDF.

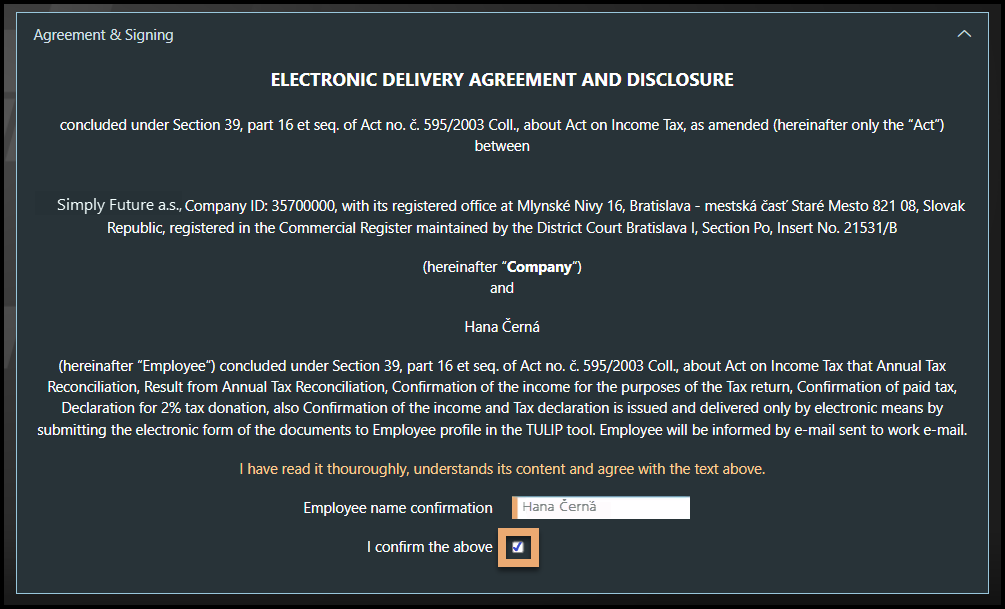

Step 8 – Agreement

Read the Agreement about Electronic delivery and disclosure.

Fill in your Name & Surname

Tick the checkbox.

The deadline for signing and submitting the form via TULIP is 15th February.

Step 9 – Sign

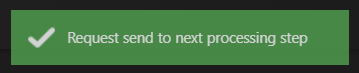

Click Sign if you completed the whole Tax Form, signed it in TULIP, and want to save and send all the information. You cannot edit your Tax Form after clicking on this button. It sends your Tax Form to HR/Payroll department for processing.

Click Back button if you want to change anything about your Tax Form.

Click Save button anytime during signing the form. This will save the information in your Tax Form, and you can return to it later co continue editing.

Click Close to leave the Tax Form. Your changes will not save and will be deleted.

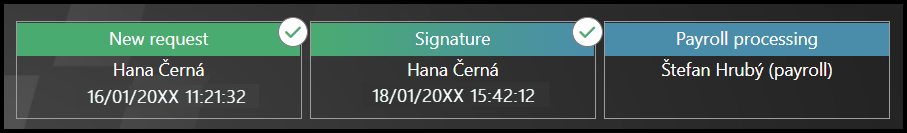

Step 10 – Next steps

HR / Payroll department makes the final check of request and approves or rejects it.

- If you must change / add something to the Tax Form, you receive an e-mail notification with explanation and the Tax form is returned to you for editing.

- If the request is successfully processed, you receive an e-mail notification once the result is available for you in My tax documents tile. The result will be processed in salaries for March, so you will receive the overpayment in your salary latest in April.

Result of Annual Tax Reconciliation

Step 1 – Tile

Go to My tax documents tile.

Step 2 – My tax documents

Find the required document and click on the name of it.